Why ‘Buy Now Pay Later’ Is The Best Choice for Credit Shopping

Author: John Smith Date Posted: 23 August 2018

When it comes to shopping, the thrill of the experience rests on the gratification you experience when you get your hands on your precious (purchase). However, sky-high price tags can often deter even the most determined buyer - especially if ‘buy now pay later’ isn’t an option.

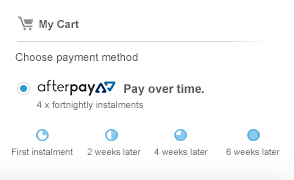

In 2017, it was found that nearly 8% of all spending on online goods were based on these types of credit schemes. Here, through the use of certain services such as Afterpay, zipMoney, and zipPay, buyers gain access to products with the option of paying the cost over a specified period of time.

Given the success of these platforms in the past few years, our blog this week takes a look at why buy now pay later schemes are the perfect choice for credit shopping.

An interest-free and deposit-free payment plan

One of the biggest incentives behind buy now pay later schemes is that they don’t incur any additional costs. Unlike loans and most other later-pay arrangements, zero interest and zero deposits mean that buyers are no worse off than if they opted for immediate purchase.

Another factor that makes these options rather lucrative is that it gives buyers a free trial of the chosen product. While there’s usually a specific number of days within which the item can be returned, this helps many buyers overcome another common hurdle - trying and testing products before payment.

A great option in times of emergency

Many individuals often find themselves in situations where they’ve busted their car lights, broken office furniture or are in need of emergency appliance/furniture replacements. In these instances, having the required cash in hand to purchase new supplies can prove to be challenging, even for those with savings.

In this regard, buy now pay later schemes are highly useful and effective. Through this kind of credit arrangement, individuals are able to buy what they need and pay off the cost in small installment over a specific period of time. Without the need to sacrifice chunks of cash or essential everyday goods and services, buy now pay later is a convenient option in emergency situations.

A less burdensome payment plan

For many, the upfront cost of paying for products can prevent the completion of a purchase. In this regard, buy now pay later schemes are the perfect solution.

Given that the payment is broken down into smaller chunks, it makes it easier for buyers to pay off their debt. As mentioned earlier, additional charges are also not included, making products very much more affordable.

Recent research shows that the majority of buy now pay later users are between the ages of 18-39. This encompasses all Australian millennials, many of whom are paid on a weekly basis. In this regard, these schemes present an irresistible pull for users who can’t afford to spare a chunk of money upfront.

Convenient and secure payment options

Another factor that makes buy now pay later schemes highly lucrative is that they represent highly convenient and secure methods of payment.

With well-established platforms such as Afterpay, buyers trust the platform on which they’re shopping. This greatly prevents the provision of confidential and highly sensitive financial information to third party websites or dubious online vendors. Unlike loans, this also means that credit checks aren’t necessary, saving buyers significant time and hassle.

It also presents an opportunity for staggered automatic payment without the need to make in-person cash transactions every week or so.

Key Takeaways

When it comes to affordable and hassle-free shopping, buy now pay later is easily one of the best options for credit purchases.

Free of onerous interest rates and hefty deposits, it is set to become one of the biggest payment trends in traditional B2C companies. Offering buyers security, affordability, and convenience, such arrangements produce a magnetic pull towards products and services that would otherwise prove to be unaffordable.

In this regard, both business and buyers have a significant interest in platforms such as Afterpay, zipPay, and zipMoney - all platforms EXTG supports.

As a leading online departmental store in Australia, access a wide range of products and shop using the secure buy now pay later services! From bathroom appliances to kitchen utensils, we’ve got it all. Visit our online store today!